massachusetts estate tax table

The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents gross estate prior to deductions exceeds the threshold.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Future changes to the federal estate tax law will not affect the Massachusetts estate tax law as the reference for Massachusetts estate tax purposes is the.

. We are ready to help. 22 rows The bottom of the threshold is 604 million so we subtract that from 62 million and get. Massachusetts Estate Tax Table 2017.

2019 Massachusetts State Tax Tables. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Massachusetts state estate tax law key 2020 wealth transfer tax numbers.

Masuzi March 3 2018 Uncategorized Leave a comment 48 Views. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The Massachusetts tax is.

The imposed Massachusetts estate tax is determined by the percentage of the taxable estate which is real and tangible property located in Massachusetts. 18 rows Tax year 2022 Withholding. Additionally because the taxable.

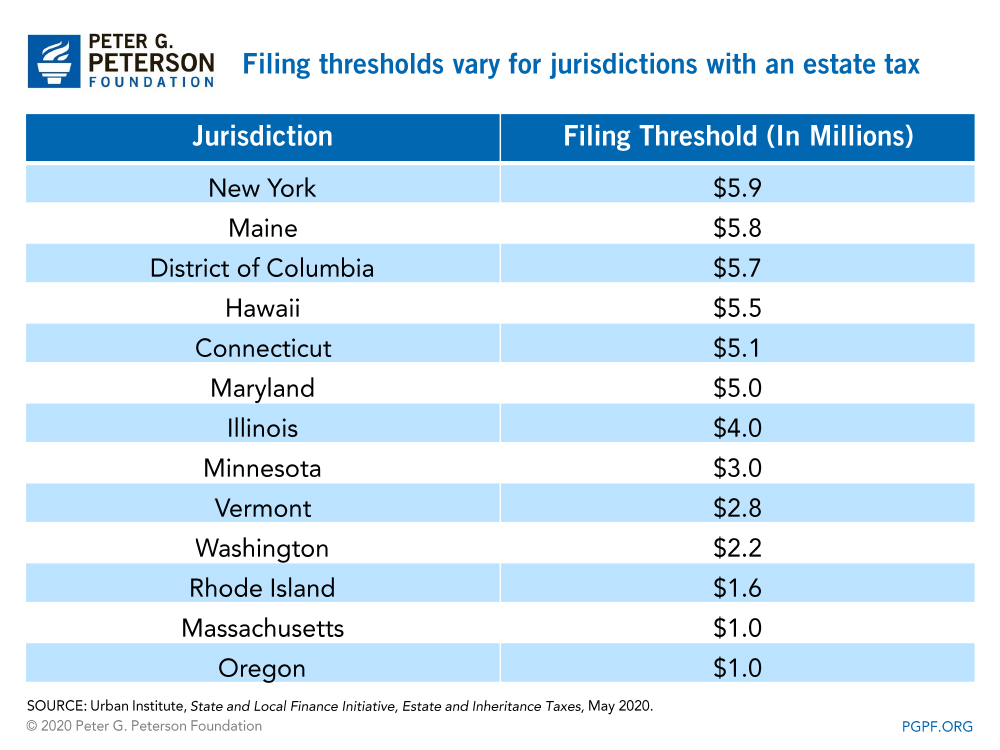

If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax. It starts with an initial consultation which is absolutely free. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary.

The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020. Greg stewart tyler perry. The estate tax is computed in graduated rates based on the total value of the estate.

The Massachusetts estate tax is. 2020 Massachusetts State Tax Tables. If youre responsible for the estate of someone who died you may need to file an estate tax return.

If the estate is worth less than 1000000 you dont need to file a return or. For estates of decedents dying in 2006 or after the applicable. Busan hotel near beach.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Prudential Center Newark Nj Seating Chart. Fake court summons template.

Massachusetts estate tax brackets range from 08 to 16 for estates over 10 million. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Up to 100 - annual filing. 2021 Massachusetts State Tax Tables. The Massachusetts State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019.

San marcos elementary school calendar. Below we have posted some of the marginal tax rates and tax liabilities associated with the values of. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Massachusetts uses a graduated tax rate which ranges between. Massachusetts Estate Tax Table. And so lets look at an excerpt from the Massachusetts estate tax table.

Floor Joist Span Tables Mgp10. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. What Jeep Models Have 3rd Row Seating.

For estates of decedents dying in 2006 or after the. We have a simple process for getting you from wherever you are now to executed and final documents.

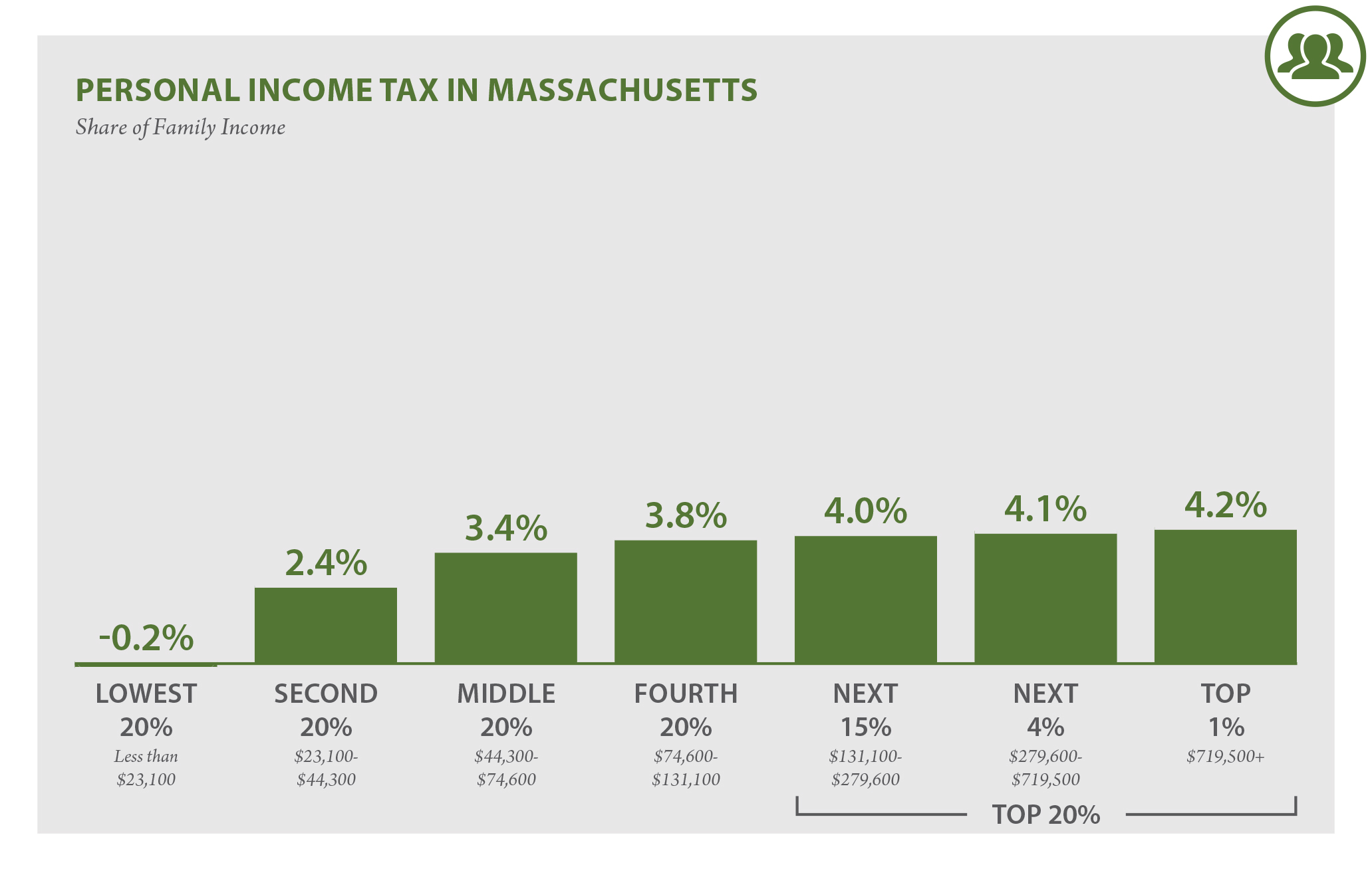

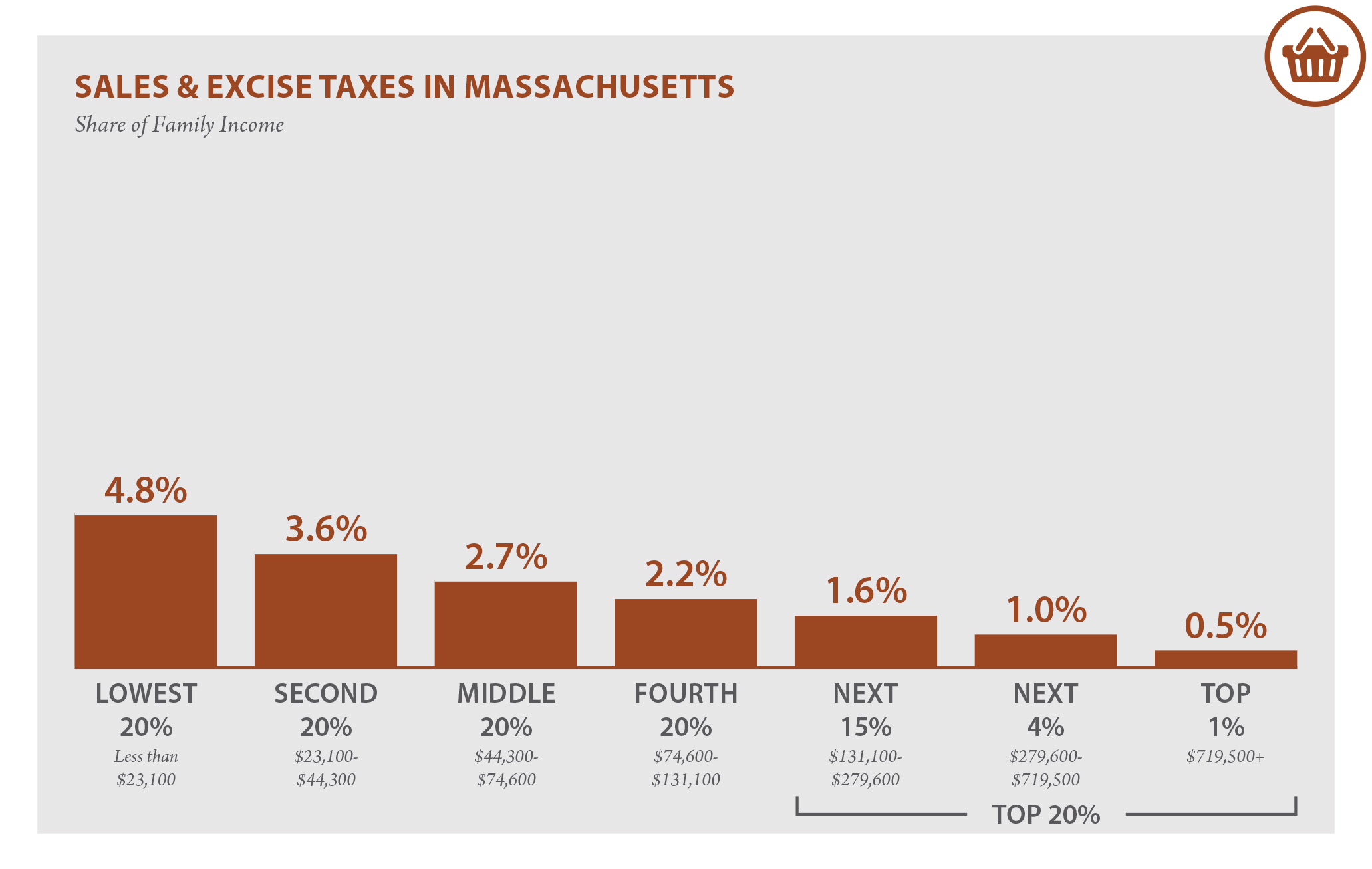

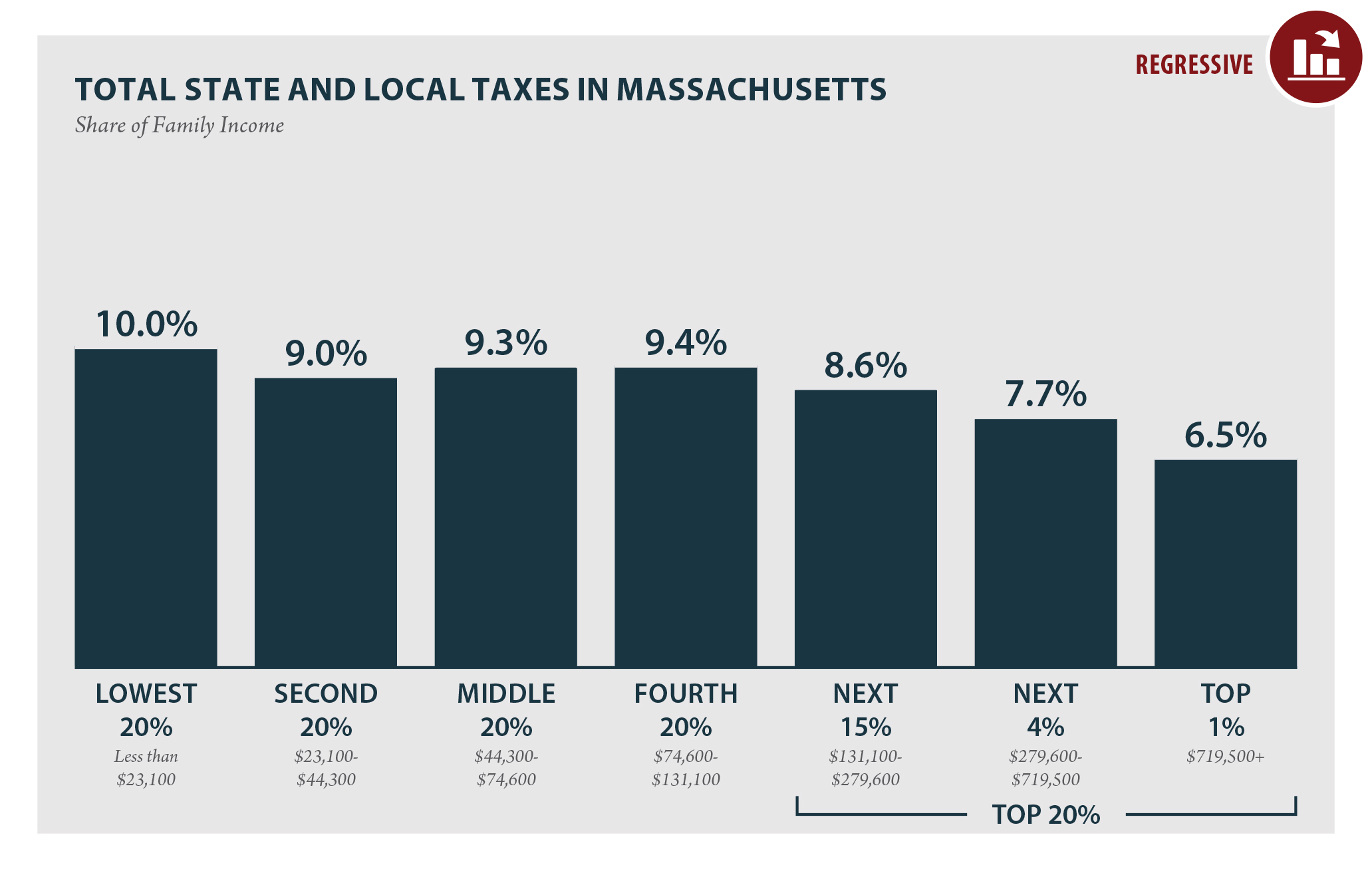

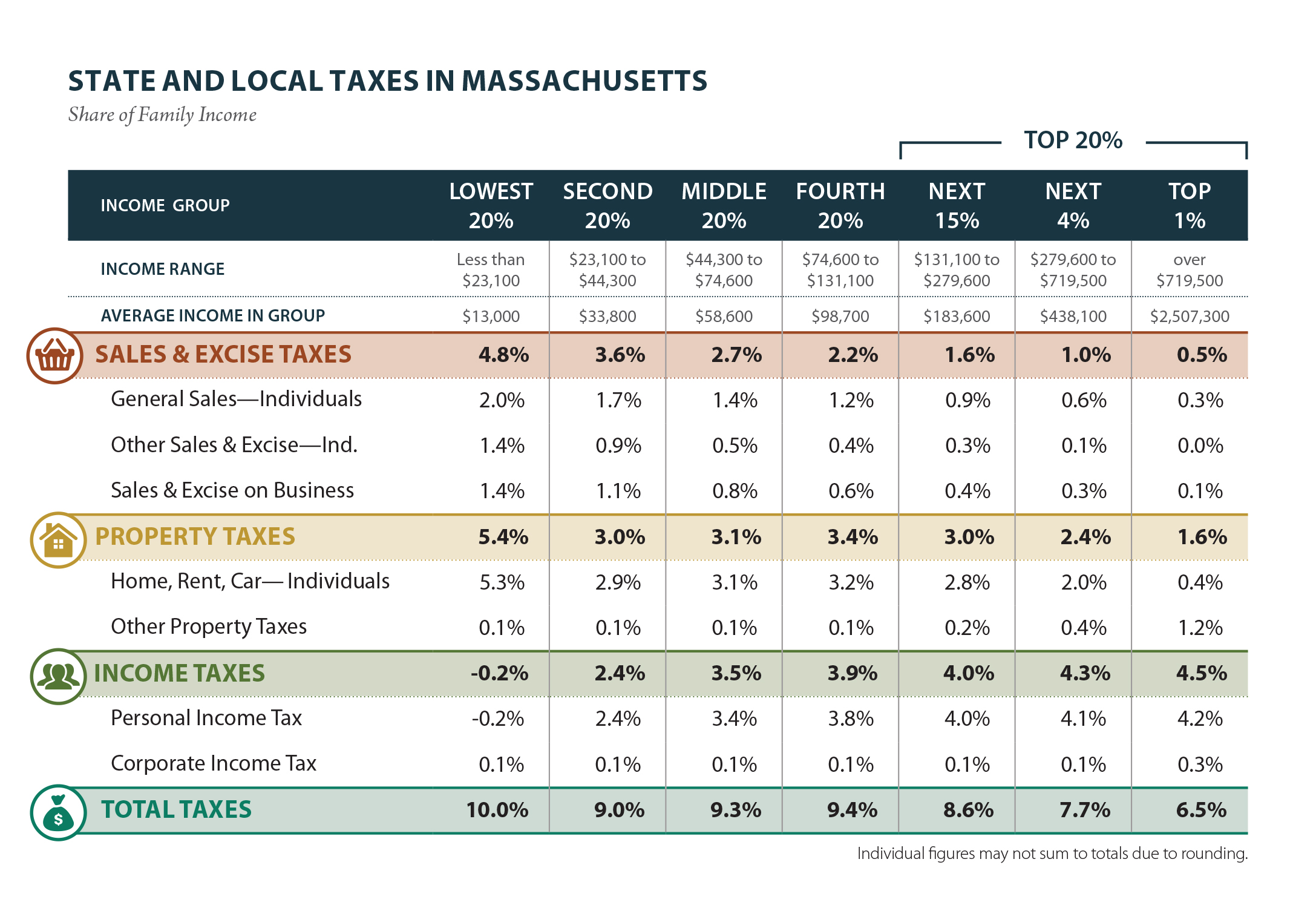

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Who Pays 6th Edition Itep

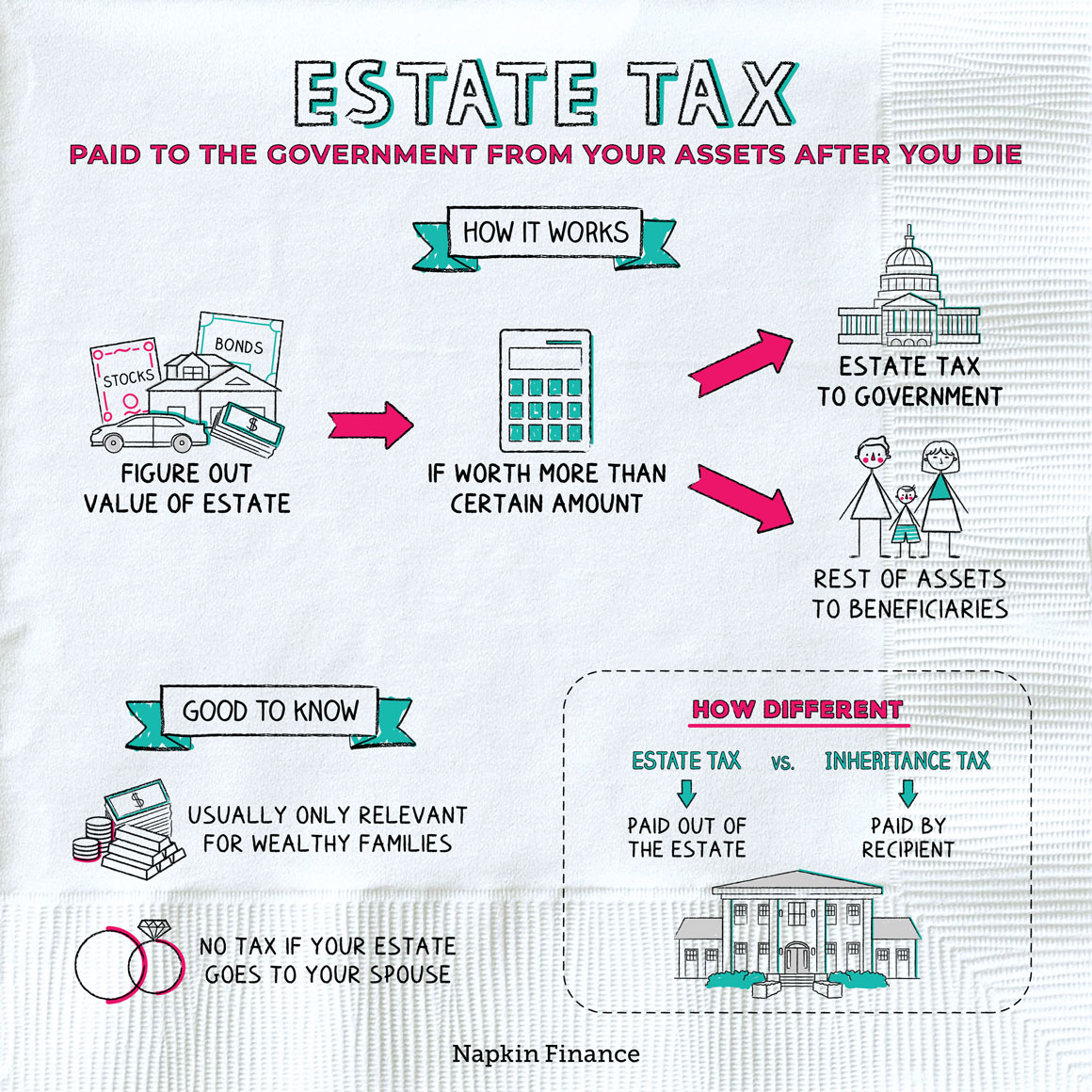

What Are Estate And Gift Taxes And How Do They Work

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Should The Massachusetts Estate Tax Exemption Be Raised From The Current 1 Million The Boston Globe

Massachusetts Estate And Gift Taxes Explained Wealth Management

Massachusetts Who Pays 6th Edition Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

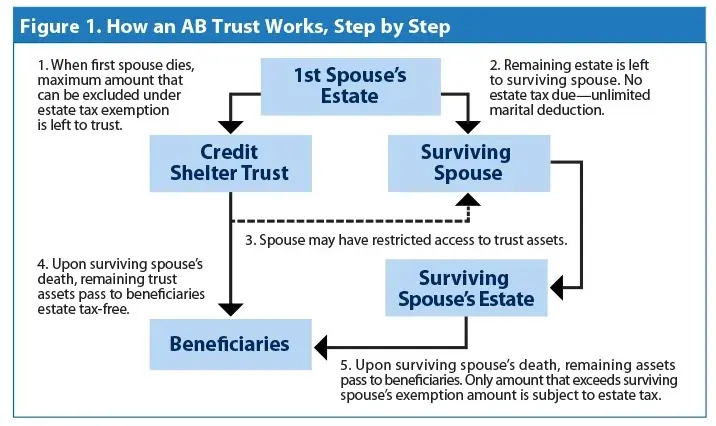

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Is Tax Liability Calculated Common Tax Questions Answered

What Is An Estate Tax Napkin Finance

Is Ab Trust Planning Still Effective

Massachusetts Estate Tax Everything You Need To Know Smartasset